Meet Empower.

A new software platform designed to increase the speed of today’s fastest-growing companies.

Today we’re announcing Empower, a new software platform designed to enable a culture of trust and financial discipline at scale. Empower will serve as the foundation for all Brex products moving forward, starting with a completely new spend management platform.

Whether your company is bringing teams together for offsites, offering stipends, booking travel, paying bills, or just expensing lunch, Empower reduces bureaucracy and overhead, increasing the speed of business.

We’re also thrilled to announce DoorDash as one of our first customers on Empower, helping increase the speed of their global, distributed team of over 9,000 employees.

"We wanted a solution that was forward-thinking and innovative and that gives autonomy and power back to the employees."

- Mike Kim, VP of Finance

Building financial software for speed.

Modern businesses are giving up the traditional model of command and control, and are instead providing context and empowering teams to make the right decisions, which greatly speeds up the pace of business.

However, financial processes have not adapted to this new reality. We were fascinated by a story told by Mike Kim, DoorDash’s VP of Finance.

Over the summer, a DoorDash warehouse general manager wanted to test offering ice as an add-on to orders. He was set to go to the grocery store to buy $1,000 of ice when he learned he was not authorized for that spend on his corporate card. When he inquired to the finance team, he was told to set up a purchase order — and five weeks later, he was still waiting for approvals to be completed.

We think there’s a better, faster model. By watching how the fastest companies operate today, we observed three core principles that became the foundation for Empower.

Principle 1

Make it easy to do the right thing.

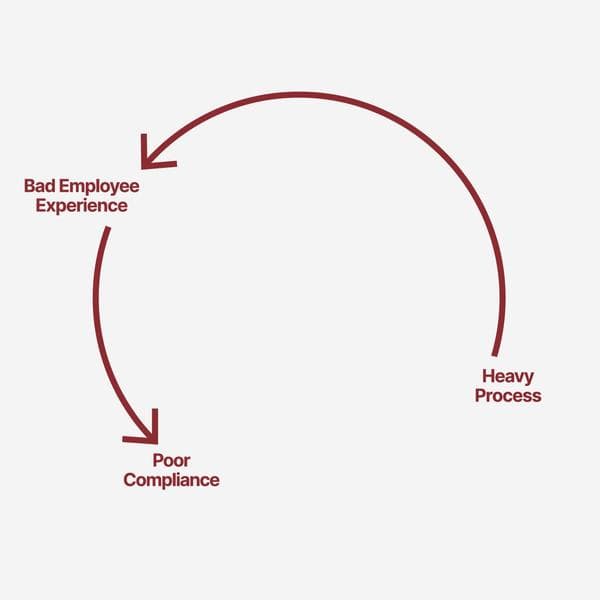

People follow processes that are easy, but complying with a company’s expense policy is not. Most employees don’t read expense policies, and hate chasing receipts, filling out memos and submitting expenses. Finance teams, then, find themselves with thousands of expenses that are not compliant, and add more process to force employees to comply. This makes it even harder to follow the process, further reducing compliance and speed.

Current solutions

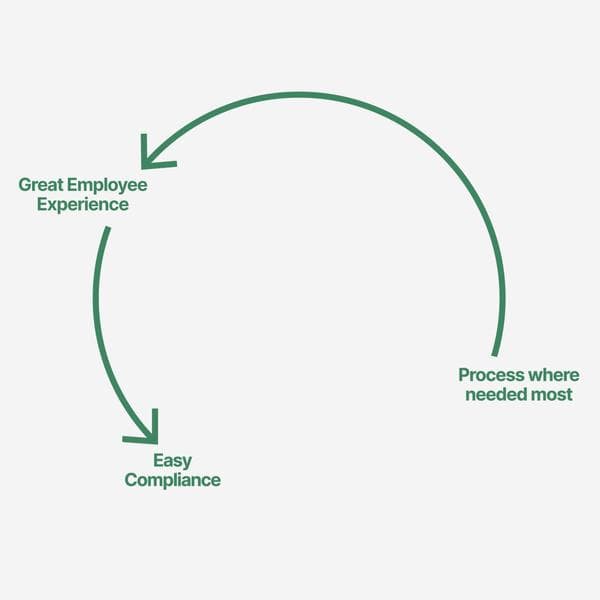

With Brex Empower

Instead, we believe every financial product should start with a great employee experience that makes it easy to do the right thing.

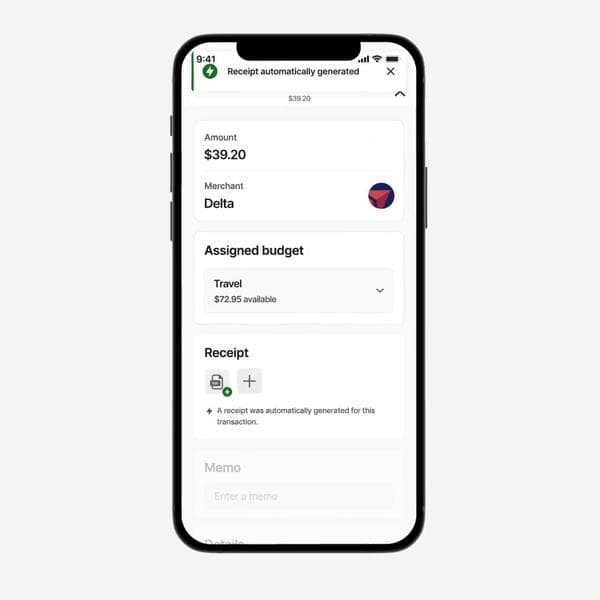

We’re eliminating the need to collect receipts for many transactions.

By leveraging exclusive data from credit card networks, and integrations with hundreds of partners, we can gather receipts for many transactions automatically without having to ask employees for them, which is especially magical for in-person expenses at restaurants, hotels, etc.

We’re making it easy to understand your expense policy.

Few employees actually read a company’s expense policy. Instead, we created a new way to visualize the expense policy and the business context for each type of expense, across cards, reimbursements and bill pay. For example, if an employee is booking travel for an offsite, we show your employee what type of travel is in policy, empowering them to be compliant right from the start.

Principle 2

Trust and verify.

At scale, leaders can’t review everything, because reviews are costly and slow. Instead, the best companies manage by exception, focusing leadership attention only where it matters the most. However, existing financial products were designed to prevent bad behavior from 5% of employees by requiring reviews for the 95% who are trying to do the right thing, which slows down the entire organization.

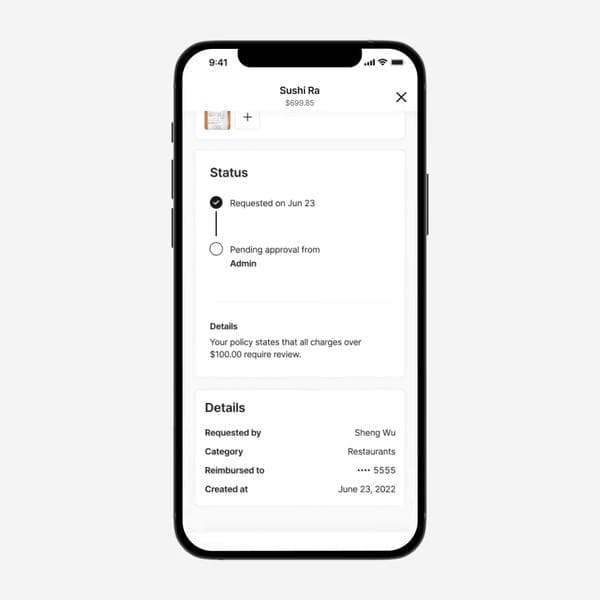

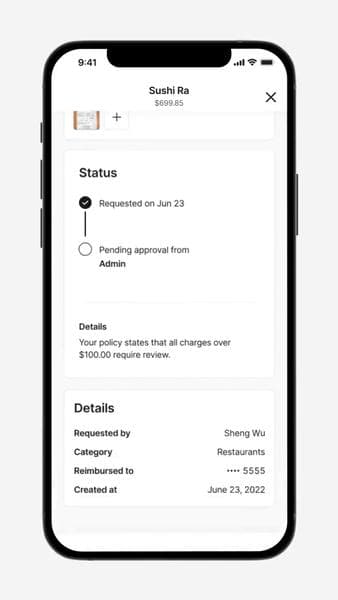

Empower creates the foundation of a “trust and verify” model. We believe no well-intentioned employee should be prevented from moving the business forward, like what happened in the DoorDash example.

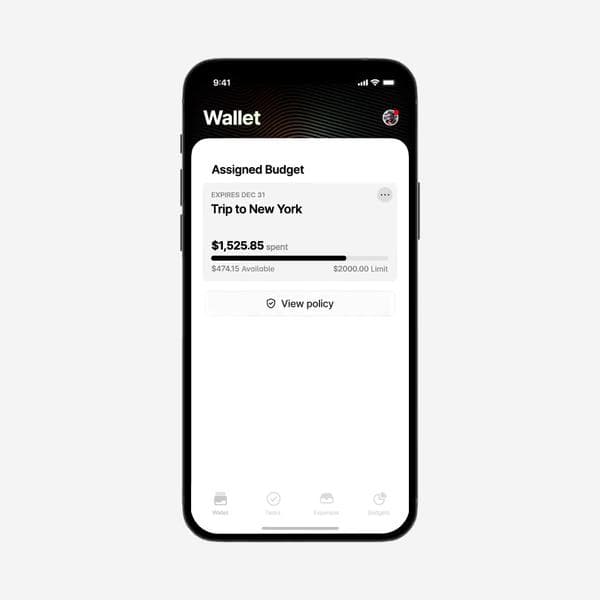

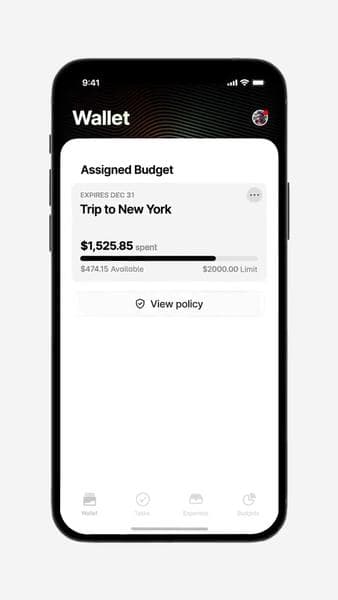

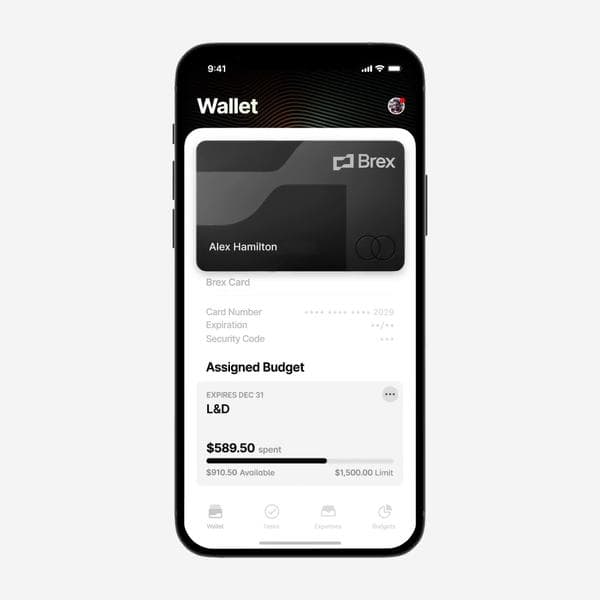

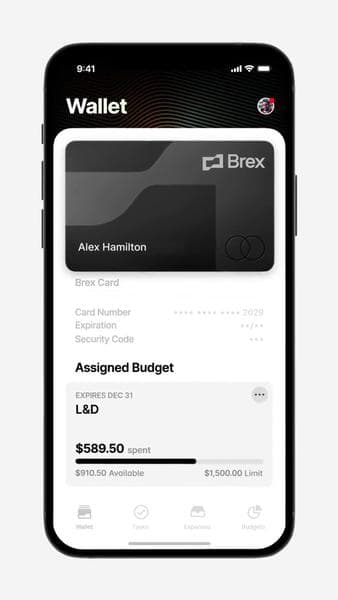

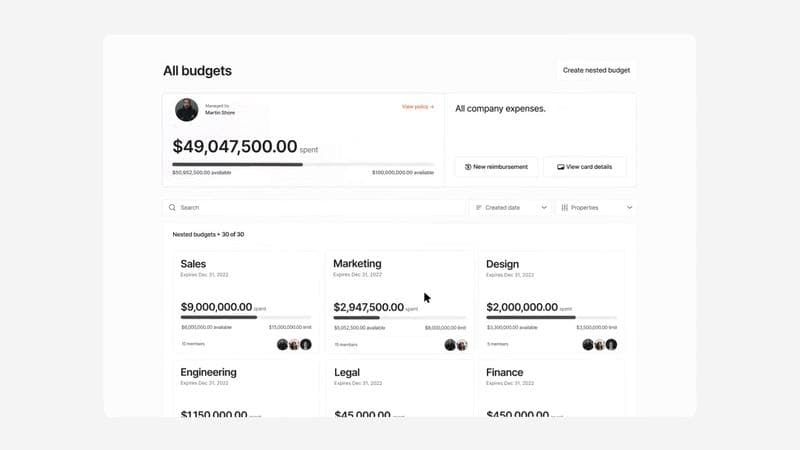

We’re introducing the concept of budgets to delegate spend.

Now, you can create and request a budget for teams, trips, vendors, stipends, and empower all leaders in your company to do the same. Budgets have clearly defined expense policies, so employees know exactly what can be spent under each budget, eliminating the need for approvals on every single expense.

We’re drastically reducing the number of reviews for managers.

Budgets allow managers to focus only on expenses that are out of policy or over budget. At the same time, we’re introducing an anomaly detection model into our review flow, leveraging machine learning to flag suspicious transactions based on data of tens of millions of transactions processed by Brex.

Principle 3

Increase accountability.

For most companies, increasing speed usually means decreasing financial discipline. But the best companies have a culture that enables both. To create a culture of speed and financial discipline, companies need systems that keep employees accountable.

However, existing financial products were built detached from the context required to drive accountability. For example, there’s no way to tell how much a team spent in an offsite before closing the books, as expenses happen on multiple cards, invoices, reimbursements, etc. This lack of visibility makes it difficult for finance teams to know where to focus, and gives leaders no clue on how much they’re spending overall.

Real-time visibility and accountability directly tied to the business context.

With Empower, finance teams have visibility into the entire org, and can understand in real-time where spend is happening, which teams are closer to hitting budgets for vendors, trips, off-sites, etc. This allows for real-time decisions on where to reduce spend, while keeping leaders financially accountable and moving faster than ever.

Empower is the biggest change to Brex since we launched, and will power everything across cards, payments, spend management, procurement, travel, and more. By making it easy to do the right thing, enabling a “trust and verify” model, and increasing accountability, Empower enables a culture of trust and financial discipline at scale, increasing the speed of business.

We’re incredibly excited to get Empower in the hands of customers, and over the next several months we’ll be migrating all of our customers and products to Empower.

We couldn’t be more excited to enable businesses to move faster, and empower them to realize their full potential. Onwards!

Pedro

See what Brex can do for your company

Spend Management