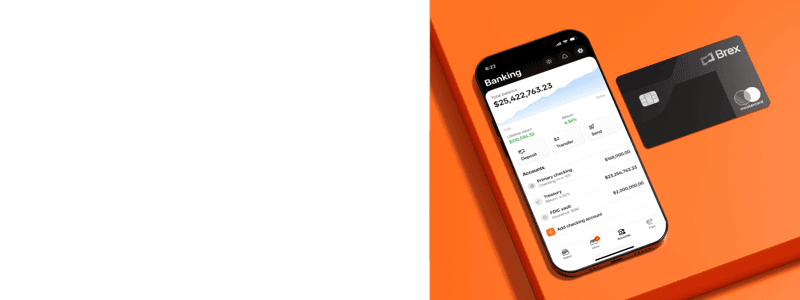

Business banking that works as hard as you do.

Earn up to 3.77%† with same-hour liquidity, no hidden fees, and no minimums. Brex offers the highest-returning, lowest-risk treasury product. Period.

TRUSTED BY 1 IN EVERY 3 STARTUPS

This is banking made powerful.

Get industry-leading return plus modern checking and FDIC insurance — all in one account.

TREASURY

Maximize earnings, minimize risk.

Earn up to 3.77%† in a treasury account with no minimum deposit.

Keep growing your cash until the moment you need it with same-hour liquidity

Minimize risk through government-backed stability, a fixed NAV, and no exposure to credit markets

Automatically top up your treasury account to maximize your returns — no extra work needed

TREASURY

Maximize earnings, minimize risk.

Earn up to 3.77%† in a treasury account with no minimum deposit.

Keep growing your cash until the moment you need it with same-hour liquidity

Minimize risk through government-backed stability, a fixed NAV, and no exposure to credit markets

Automatically top up your treasury account to maximize your returns — no extra work needed

CHECKING

Pay and get paid faster.

Save time and optimize your cash flow with invoicing and accounts payable built right into your banking.

Automate your AP from bill entry to payment with Brex bill pay — it comes with your account!

Create and send branded invoices right from in Brex and automatically track when you get paid

Send unlimited same-day ACH payments anywhere, for free

CHECKING

Pay and get paid faster.

Save time and optimize your cash flow with invoicing and accounts payable built right into your banking.

Automate your AP from bill entry to payment with Brex bill pay — it comes with your account!

Create and send branded invoices right from in Brex and automatically track when you get paid

Send unlimited same-day ACH payments anywhere, for free

VAULT

Stash your cash with confidence.

Keep your money secure with advanced fraud and data protection.

Get up to $6M in FDIC coverage through 24 partner banks

Enjoy 24/7 support and enterprise-grade security

Control payments with custom approval rules and vendor safe lists

VAULT

Stash your cash with confidence.

Secure your cash with advanced fraud and data protection.

Get up to $6M in FDIC coverage through 24 partner banks

Enjoy 24/7 support and enterprise-grade security

Control payments with custom approval rules and vendor safe lists

VAULT

Stash your cash with confidence.

Secure your cash with advanced fraud and data protection.

Get up to $6M in FDIC coverage through 24 partner banks

Enjoy 24/7 support and enterprise-grade security

Control payments with custom approval rules and vendor safe lists

Business banking designed for speed, at scale.

Earn returns from day one.

Deposit funds and earn returns on your first dollar

Create Brex cards for seamless payments

Connect your payroll, ERP, and HRIS

Automate banking busywork.

Automate AP with integrated bill pay

Send customized, recurring invoices to your customers

Sync transactions directly with your ERP

Operate globally with ease.

Make payments in 60+ local currencies

Fund employee reimbursements in 60+ countries

Automate spend controls and approval flows

Earn returns from day one.

Deposit funds and earn returns on your first dollar

Create Brex cards for seamless payments

Connect your payroll, ERP and HRIS

Automate banking busywork.

Automate AP with integrated bill pay

Send customized, recurring invoices to your customers

Sync transactions directly with your ERP

Operate globally with ease.

Make payments in 60+ local currencies

Fund employee reimbursements in 60+ countries

Automate spend controls and approval flows

Don’t just store your cash. Grow it.

Earn yield from your first dollar — with no minimum required and same-hour liquidity.

Displaying estimated return of assuming funds held

Total balance

$20M+

$5M-$20M

$2M-$5M

$500K-$2M

$0-$500K

Total treasury return

3.77%†

3.62%

3.57%

3.47%

3.42%

Total balance

$20M+

$5M-$20M

$2M-$5M

$500K-$2M

$0-$500K

Total treasury return

3.77%†

3.62%

3.57%

3.47%

3.42%

Get started in minutes.

Open an account today and start banking easier and growing your cash faster, with less risk.

Get started in minutes.

Open an account today and start banking easier and growing your cash faster, with less risk.

FAQ